Semua tulisan dari Ahmad Sobirin

Tutorials Trading, What is Elliott Wave?

What is Elliott Wave?

[…] the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave.– Prechter, R. R. The Elliott Wave Principle (p.19).

The basic Elliott Wave pattern

Motive Waves

-

Wave 2 can’t retrace more than 100% of the preceding wave 1 move.

-

Wave 4 can’t retrace more than 100% of the preceding wave 3 move.

-

Among waves 1, 3, and 5, wave 3 can’t be the shortest, and is often the longest one. Also, Wave 3 always moves past the end of Wave 1.

Corrective Waves

Does Elliott Wave work?

Closing thoughts

Trading Tutorials, What is the Parabolic SAR?

What is the Parabolic SAR?

SAR stands for Stop and Reverse. This is the point at which a Long trade is exited and a Short trade is entered, or vice versa.– Wilder, J. W., Jr. (1978). New Concepts in Technical Trading Systems (p. 8).

How does it work?

Benefits

Limitations

The Parabolic SAR calculation

Closing Thoughts

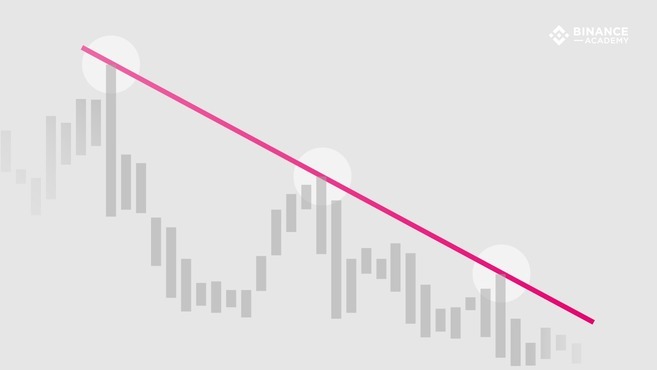

Trading Tutorial, What are trend lines?

What are trend lines?

How to use trend lines

Drawing valid trend lines

Scale settings

Closing thoughts

Guid Tutorial Trading, What are leading and lagging indicators?

What are leading and lagging indicators?

How do leading and lagging indicators work?

Leading indicators

Lagging indicators

Coincident indicators

Uses in technical analysis

Uses in macroeconomics

Closing thoughts

Tutorials Trading Bitcoin, What is market psychology?

What is market psychology?

How do emotions change during market cycles?

Uptrend

Downtrend

How do investors use market psychology?

Technical analysis and market psychology

Bitcoin and market psychology

Cognitive biases

- Confirmation bias: the tendency to overvalue information that confirms our own beliefs, while ignoring or dismissing information that runs contrary to them. For example, investors in a bull market may put a stronger focus on positive news, while ignoring bad news or signs that the market trend is about to reverse.

- Loss aversion: the common tendency of humans to fear losses more than they enjoy gains, even if the gain is similar or greater. In other words, the pain of a loss is usually more painful than the joy of a gain. This may cause traders to miss good opportunities or to panic sell during periods of market capitulation.

- Endowment effect: This is the tendency for people to overvalue things that they own, simply because they own it. For example, an investor that owns a bag of cryptocurrency is more likely to believe it has value than a no-coiner.

Closing thoughts

Tutorials Trading,What is a futures contract?

What is a futures contract?

Why users trade futures contracts?

- Hedging and risk management: this was the main reason why futures were invented.

- Short exposure: traders can bet against an asset’s performance even if they don’t have it.

- Leverage: traders can enter positions that are larger than their account balance. On Binance, perpetual futures contracts can be traded with a leverage that goes up to 125x.

What is a perpetual futures contract?

What is the initial margin?

What is the maintenance margin?

What is liquidation?

What is the funding rate?

What is the mark price?

What is PnL?

What is the Insurance Fund?

What is Auto-deleveraging?

Trading Tutorials, Ichimoku Clouds Explained

Trading Tutorials, Ichimoku Clouds Explained

How does it work?

-

Conversion Line (Tenkan-sen): 9-period moving average.

-

Base Line (Kijun-sen): 26-period moving average.

-

Leading Span A (Senkou Span A): the moving average of the Conversion and Base Lines projected 26 periods in the future.

-

Leading Span B (Senkou Span B): 52-period moving average projected 26 periods in the future.

-

Lagging Span (Chikou Span): the closing price of the current period projected 26 periods in the past.

Ichimoku settings

Analyzing the chart

Ichimoku trading signals

-

Momentum signals

-

Market price moving above (bullish) or below (bearish) the Base Line.

-

TK cross: Conversion Line moving above (bullish) or below (bearish) the Base Line.

-

-

Trend-following signals

-

Market price moving above (bullish) or below (bearish) the cloud.

-

Cloud color changes from red to green (bullish) or from green to red (bearish).

-

Lagging Span above (bullish) or below (bearish) market prices.

-

Support and resistance levels

Signal strength

Closing thoughts

Tutorials Trading Binance, What Are Options Contracts?

What Are Options Contracts?

How do options contracts work?

Options premium

|

Call options premium

|

Put options premium

|

|

|

Rising asset’s price

|

Increases

|

Decreases

|

|

Higher strike price

|

Decreases

|

Increases

|

|

Decreasing time

|

Decreases

|

Decreases

|

|

Volatility

|

Increases

|

Increases

|

Options Greeks

-

Delta: measures how much the price of an options contract will change in relation to the underlying asset’s price. For instance, a Delta of 0.6 suggests that the premium price will likely move $0.60 for every $1 move in the asset’s price.

-

Gamma: measures the rate of change in Delta over time. So if Delta changes from 0.6 to 0.45, the option’s Gamma would be 0.15.

-

Theta: measures price change in relation to a one-day decrease in the contract’s time. It suggests how much the premium is expected to change as the options contract gets closer to expiration.

-

Vega: measures the rate of change in a contract price in relation to a 1% change in the implied volatility of the underlying asset. An increase in Vega would normally reflect an increase in the price of both calls and puts.

-

Rho: measures expected price change in relation to fluctuations in interest rates. Increased interest rates generally cause an increase in calls and a decrease in puts. As such, the value of Rho is positive for call options and negative for put options.

Common use cases

Hedging

Speculative trading

Basic strategies

-

Protective put: involves buying a put option contract of an asset that is already owned. This is the hedging strategy used by Alice in the previous example. It is also known as portfolio insurance as it protects the investor from a potential downtrend, while also maintaining their exposure in case the asset’s price increases.

-

Covered call: involves selling a call option of an asset that is already owned. This strategy is used by investors to generate additional income (options premium) from their holdings. If the contract is not exercised, they earn the premium while keeping their assets. However, if the contract is exercised due to an increase in the market price, they are obligated to sell their positions.

-

Straddle: involves buying a call and a put on the same asset with identical strike prices and expiration dates. It allows the trader to profit as long as the asset moves far enough in either direction. Simply put, the trader is betting on market volatility.

-

Strangle: involves buying both a call and a put that are “out-of-the-Money” (i.e., strike price above market price for call options and below for put options). Basically, a strangle is like a straddle, but with lower costs for establishing a position. However, a strangle requires a higher level of volatility to be profitable.

Advantages

-

Suitable for hedging against market risks.

-

More flexibility in speculative trading.

-

Allow for several combinations and trading strategies, with unique risk/reward patterns.

-

Potential to profit from all the bull, bear, and side-way market trends.

-

May be used for reducing costs when entering positions.

-

Allow multiple trades to be performed simultaneously.

Disadvantages

-

Working mechanisms and premium calculation not always easy to understand.

-

Involves high risks, especially for contract writers (sellers)

-

More complex trading strategies when compared to conventional alternatives.

-

Options markets are often plagued with low levels of liquidity, making them less attractive for most traders.

-

The premium value of options contracts is highly volatile and tends to decrease as the expiration date gets closer.

Options vs. futures

Closing thoughts

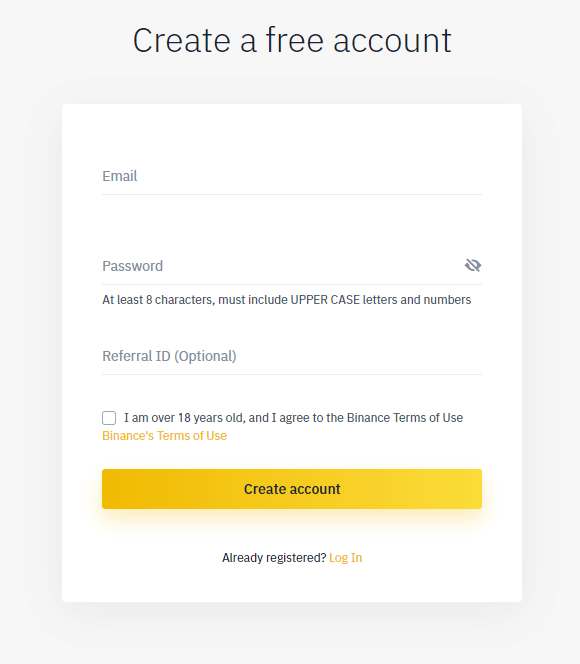

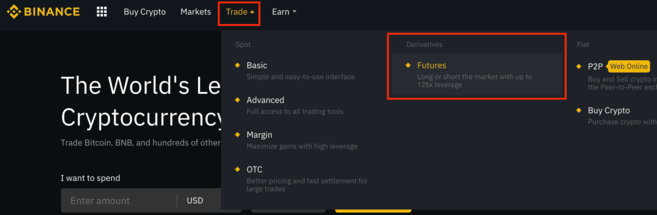

Binance Totorials, Guide to Trading on Binance Futures

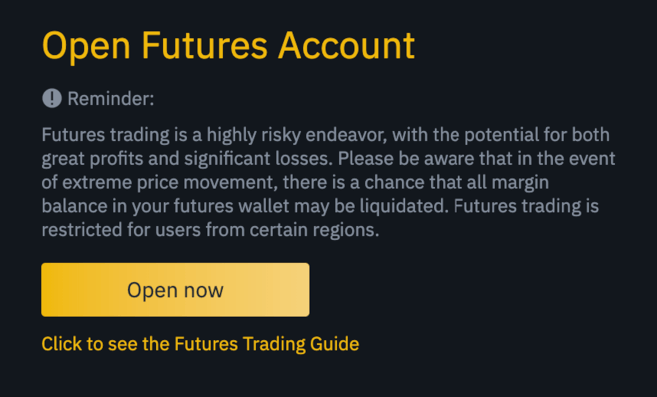

How to open a Binance Futures account

- Enter your email address and create a safe password. If you have a referral ID, paste it in the referral ID box. For a 10% discount on spot/margin trading fees, you can use this link.

- When you are ready, click on Create account.

- You will receive a verification email shortly. Follow the instructions in the email to complete your registration.

How to fund your Binance Futures account

If you don’t have any funds deposited to Binance, we recommend reading the guide How to Deposit on Binance.

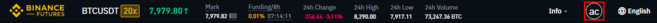

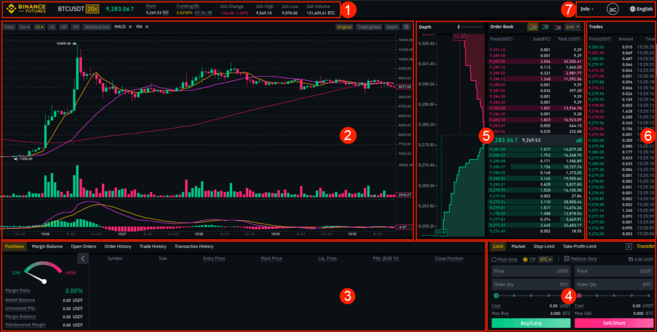

Binance Futures interface guide

- This is where you can:

- Choose the contract you’d like to trade, adjust your leverage (20x by default), and switch between cross margin and isolated margin.

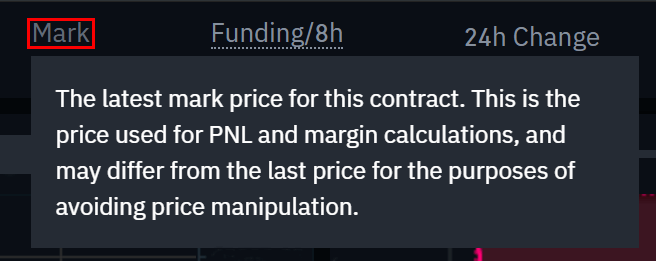

- Check the Mark Price (important to keep an eye on, as liquidations happen based on the Mark Price).

- Check the expected funding rate.

- Monitor your position in the auto-deleverage queue (important to pay attention to during periods of high volatility).

- Check various other market data, such as 24h change and 24h volume.

- This is your chart. In the top right corner of this area, you can switch between the Original or the integrated TradingView chart, or get a real-time visual representation of the current order book depth by clicking on Depth.

- This is where you can monitor your trading activity. You can switch between the tabs to check the current status of your positions, your margin balance, see your currently open and previously executed orders, and get a full trading and transaction history for a given period.

- This is where you can enter your orders, and switch between different order types. This is also where you can check your fee tier, and transfer funds from your Binance account.

- This is where you can see live order book data along with a visualization of order depth. You can adjust the accuracy of the order book in the dropdown menu on the top right corner of this area (0.01 by default).

- This is where you can see a live feed of the trade history of Binance Futures.

- By hovering on Info, you can get access to the Futures FAQ, check the historical funding rates, and the current balance of the Insurance Fund. If you wish to log out of Binance Futures, you can also do that from here.

How to adjust your leverage

What is the difference between the Mark Price and Last Price?

What order types are available and when to use them?

-

Limit: A limit order is an order that you place on the order book with a specific limit price that is determined by you. When you place a limit order, the trade will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to buy at a lower price, or to sell at a higher price than the current market price.

-

Market: A market order is an order to buy or sell at the best available current price. It is executed against the limit orders that were previously placed on the order book. When placing a market order, you will pay fees as a market taker.

-

Stop-Limit: The easiest way to understand a stop-limit order is to break it down into stop price, and limit price. The stop price is simply the price that triggers the limit order, and the limit price is the price of the limit order that is triggered. This means that once your stop price has been reached, your limit order will be immediately placed on the order book.

Although the stop and limit prices can be the same, this is not a requirement. In fact, it would be safer for you to set the stop price (trigger price) a bit higher than the limit price for sell orders, or a bit lower than the limit price for buy orders. This increases the chances of your limit order getting filled after the stop price is reached.

-

Stop-Market: Similarly to a stop-limit order, a stop-market order uses a stop price as a trigger. However, when the stop price is reached, it triggers a market order instead.

-

Take-Profit-Limit: If you understand what a stop-limit order is, you will easily understand what a take-profit-limit order is. Similarly to a stop-limit order, it involves a trigger price, the price that triggers the order, and a limit price, the price of the limit order that is then added to the order book. The key difference between a stop-limit order and a take-profit-limit order is that a take-profit-limit order can only be used to reduce open positions.

A take-profit-limit order can be a useful tool to manage risk and lock in profit at specified price levels. It can also be used in conjunction with other order types, such as stop-limit orders, allowing you to have more control over your positions.

Please note that these are not OCO orders. For example, if your stop-limit order is hit while you also have an active take-profit-limit order, the take-profit-limit order remains active until you manually cancel it.

You can set a take-profit-limit order under the Stop Limit option in the order entry field. -

Take-Profit-Market: Similarly to a take-profit-limit order, a take-profit-market order uses a stop price as a trigger. However, when the stop price is reached, it triggers a market order instead.

You can set a take-profit-market order under the Stop Market option in the order entry field.

How to use the Binance Futures calculator

-

PNL – Use this tab to calculate your Initial Margin, Profit and Loss (PnL), and Return on Equity (ROE) based on intended entry and exit price, and position size.

-

Target Price – Use this tab to calculate what price you’ll need to exit your position at to reach a desired percentage return.

- Liquidation Price – Use this tab to calculate your estimated liquidation price based on your wallet balance, your intended entry price, and position size.

What is Post-Only, Time in Force and Reduce-Only?

Post-Only means that your order will always be added to the order book first and will never execute against an existing order in the order book. This is useful if you would only like to pay maker fees. You can quickly check your current fee tier by hovering over the $ sign next to the Transfer button.

-

GTC (Good Till Cancel): The order will remain active until it is either filled or canceled.

-

IOC (Immediate Or Cancel): The order will execute immediately (either fully or partially). If it is only partially executed, the unfilled portion of the order will be canceled.

-

FOK (Fill Or Kill): The order must be fully filled immediately. If not, it won’t be executed at all.

When are your positions at risk of getting liquidated?

What is auto-deleveraging and how can it affect you?