How to open a Binance Futures account

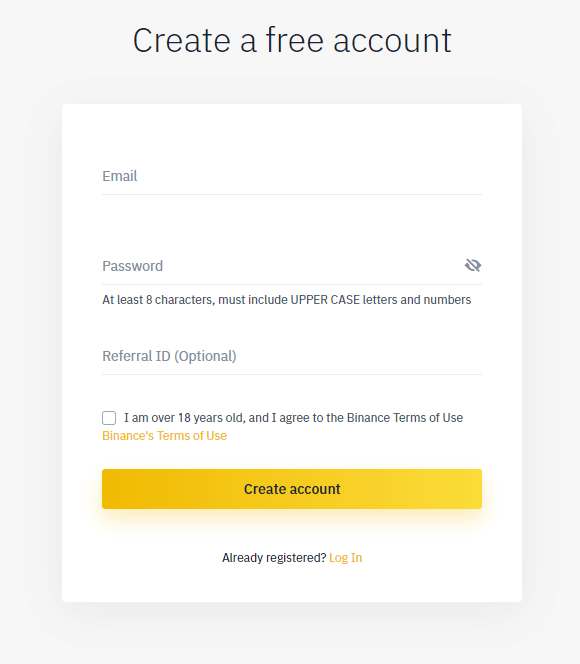

- Enter your email address and create a safe password. If you have a referral ID, paste it in the referral ID box. For a 10% discount on spot/margin trading fees, you can use this link.

- When you are ready, click on Create account.

- You will receive a verification email shortly. Follow the instructions in the email to complete your registration.

How to fund your Binance Futures account

If you don’t have any funds deposited to Binance, we recommend reading the guide How to Deposit on Binance.

Binance Futures interface guide

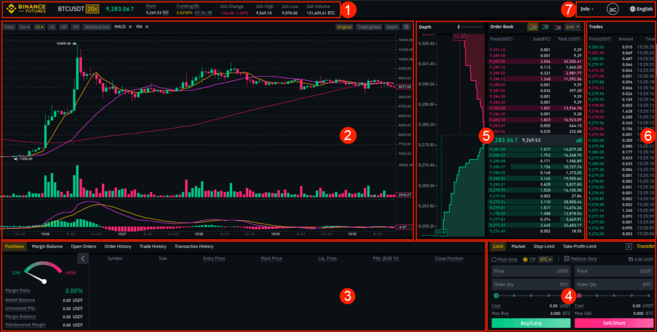

- This is where you can:

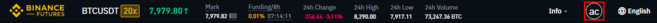

- Choose the contract you’d like to trade, adjust your leverage (20x by default), and switch between cross margin and isolated margin.

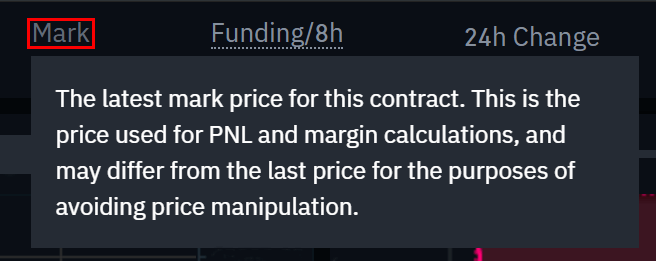

- Check the Mark Price (important to keep an eye on, as liquidations happen based on the Mark Price).

- Check the expected funding rate.

- Monitor your position in the auto-deleverage queue (important to pay attention to during periods of high volatility).

- Check various other market data, such as 24h change and 24h volume.

- This is your chart. In the top right corner of this area, you can switch between the Original or the integrated TradingView chart, or get a real-time visual representation of the current order book depth by clicking on Depth.

- This is where you can monitor your trading activity. You can switch between the tabs to check the current status of your positions, your margin balance, see your currently open and previously executed orders, and get a full trading and transaction history for a given period.

- This is where you can enter your orders, and switch between different order types. This is also where you can check your fee tier, and transfer funds from your Binance account.

- This is where you can see live order book data along with a visualization of order depth. You can adjust the accuracy of the order book in the dropdown menu on the top right corner of this area (0.01 by default).

- This is where you can see a live feed of the trade history of Binance Futures.

- By hovering on Info, you can get access to the Futures FAQ, check the historical funding rates, and the current balance of the Insurance Fund. If you wish to log out of Binance Futures, you can also do that from here.

How to adjust your leverage

What is the difference between the Mark Price and Last Price?

What order types are available and when to use them?

-

Limit: A limit order is an order that you place on the order book with a specific limit price that is determined by you. When you place a limit order, the trade will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to buy at a lower price, or to sell at a higher price than the current market price.

-

Market: A market order is an order to buy or sell at the best available current price. It is executed against the limit orders that were previously placed on the order book. When placing a market order, you will pay fees as a market taker.

-

Stop-Limit: The easiest way to understand a stop-limit order is to break it down into stop price, and limit price. The stop price is simply the price that triggers the limit order, and the limit price is the price of the limit order that is triggered. This means that once your stop price has been reached, your limit order will be immediately placed on the order book.

Although the stop and limit prices can be the same, this is not a requirement. In fact, it would be safer for you to set the stop price (trigger price) a bit higher than the limit price for sell orders, or a bit lower than the limit price for buy orders. This increases the chances of your limit order getting filled after the stop price is reached.

-

Stop-Market: Similarly to a stop-limit order, a stop-market order uses a stop price as a trigger. However, when the stop price is reached, it triggers a market order instead.

-

Take-Profit-Limit: If you understand what a stop-limit order is, you will easily understand what a take-profit-limit order is. Similarly to a stop-limit order, it involves a trigger price, the price that triggers the order, and a limit price, the price of the limit order that is then added to the order book. The key difference between a stop-limit order and a take-profit-limit order is that a take-profit-limit order can only be used to reduce open positions.

A take-profit-limit order can be a useful tool to manage risk and lock in profit at specified price levels. It can also be used in conjunction with other order types, such as stop-limit orders, allowing you to have more control over your positions.

Please note that these are not OCO orders. For example, if your stop-limit order is hit while you also have an active take-profit-limit order, the take-profit-limit order remains active until you manually cancel it.

You can set a take-profit-limit order under the Stop Limit option in the order entry field. -

Take-Profit-Market: Similarly to a take-profit-limit order, a take-profit-market order uses a stop price as a trigger. However, when the stop price is reached, it triggers a market order instead.

You can set a take-profit-market order under the Stop Market option in the order entry field.

How to use the Binance Futures calculator

-

PNL – Use this tab to calculate your Initial Margin, Profit and Loss (PnL), and Return on Equity (ROE) based on intended entry and exit price, and position size.

-

Target Price – Use this tab to calculate what price you’ll need to exit your position at to reach a desired percentage return.

- Liquidation Price – Use this tab to calculate your estimated liquidation price based on your wallet balance, your intended entry price, and position size.

What is Post-Only, Time in Force and Reduce-Only?

Post-Only means that your order will always be added to the order book first and will never execute against an existing order in the order book. This is useful if you would only like to pay maker fees. You can quickly check your current fee tier by hovering over the $ sign next to the Transfer button.

-

GTC (Good Till Cancel): The order will remain active until it is either filled or canceled.

-

IOC (Immediate Or Cancel): The order will execute immediately (either fully or partially). If it is only partially executed, the unfilled portion of the order will be canceled.

-

FOK (Fill Or Kill): The order must be fully filled immediately. If not, it won’t be executed at all.

When are your positions at risk of getting liquidated?

What is auto-deleveraging and how can it affect you?