How to open a Margin Trading account on Binance

After logging in to your Binance account, move your mouse to the top right corner to and hover over your profile icon. This will be different for everyone and will show the first two characters of your email address. When the dropdown opens, click on your email to go to your account dashboard.

If you don’t know what margin trading is, we recommend reading our article “What is Margin Trading” before opening your margin trading account on Binance.

You will now be on your account dashboard. You can see your account balances from this page. Below “Balance Details” click on “Margin” to begin the process of opening your margin trading account on Binance. You will need to have completed identity verification (KYC) and make sure your country is not in the blacklist. It is also mandatory that you enable 2FA.

Next, you will see a reminder about the risks of margin trading. Please read it and, if you are willing to proceed, click on the “Open margin account” button.

Please take the time to read the margin account agreement carefully. If you understand and agree to the Terms and Conditions, tick the box and click “I understand.”

How to transfer funds

After activating your margin account, you will be able to transfer funds from your regular Binance Wallet to your Margin Trading Wallet. To do so, click on the “Wallet” tab, select “Margin” and click on the “Transfer” button on the right side of the page.

Next, select which coin you wish to transfer. In this case, we will use the BNB.

Input the amount you want to transfer from your Exchange Wallet to your Margin Wallet and click “Confirm transfer.”

How to borrow funds

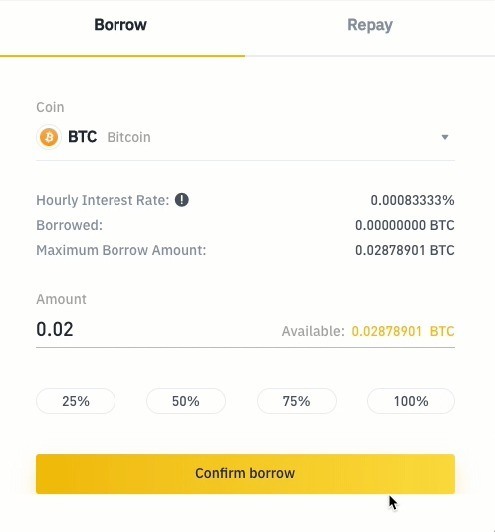

After transferring BNB coins to your Margin Wallet, you will be able to use those coins as collateral to borrow funds. Your Margin Wallet balance determines the amount of funds you can borrow, following a fixed rate of 5:1 (5x). So if you have 1 BTC, you can borrow 4 more. In this example, we will borrow 0.02 BTC.

After selecting the coin you wish to borrow and the amount, click “Confirm borrow.”

Next, your margin account will be credited with the Bitcoin you borrowed. You will now be able to trade the borrowed funds while having a debt of 0.02 BTC plus the interest rate. The interest rate is updated every 1 hour. You can check the currently available pairs as well as their rates on the Margin Fee page.

You can check your current margin account status by going to your “Wallet Balance” page and selecting the “Margin” tab.

The Margin Level

On the right side of the screen, you will see your margin level, which gives you a risk level according to the borrowed funds (Total Debt) and to the funds you hold as collateral on your margin account (Account Equity).

The risk level changes according to the market movements, so if the prices move against your prediction, your assets can be liquidated. Note that in case you are liquidated, you will be charged extra fees.

The formula to calculate the margin level is:

Margin Level = Total Asset Value / (Total Borrowed + Total Accrued Interest)

If your margin level drops to 1.3, you will receive a Margin Call, which is a reminder that you should either increase your collateral (by depositing more funds) or reduce your loan (by repaying what you’ve borrowed).

If your margin level drops to 1.1, your assets will be automatically liquidated, meaning that Binance will sell your funds at market price to repay the loan.

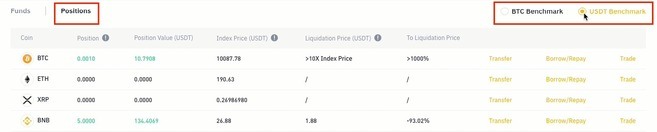

Click on “Positions” to check detailed information about your current positions. If you prefer to see the values in USDT, select “USDT Benchmark” on the right side.

How to trade on margin

If you wish to use your borrowed funds to trade, you can go to the Exchange page, select the “Margin” tab, and trade normally using Limit, Market, Stop-Limit, and OCO orders.

How to repay your debt

To repay your debt, click on “Borrow/Repay” button and select the “Repay” tab.

The total amount to be paid is the sum of the total borrowed plus the interest rates. Make sure you have the required balance before proceeding.

When you are ready, select the coin and amount you wish to repay, and click “Confirm repayment.” Note that you can only use the same cryptocurrency to make the repayment.

The switch button

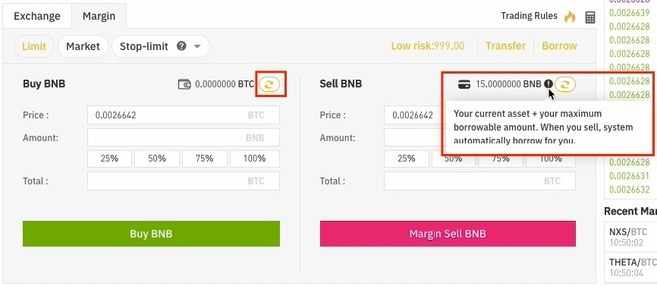

You will notice that the margin interface has a switch button next to your balances. This button allows you to switch between asset mode (normal orders) and margin mode (margin orders).

For example, if you hold 5 BNB in your Margin account, you can sell a total of 15 BNB.

Note that now you have the “Margin Sell BNB” button rather than the regular “Sell BNB”.

So, if you decide to “Margin Sell” 7 BNB, the system will automatically borrow 2 BNB for you (remember that your actual balance is 5 BNB).

After clicking “Margin Sell BNB,” you see the following confirmation message:

So, the Switch button allows you to quickly borrow funds when opening new positions. However, you have to repay the borrowed funds manually afterward.

Moving funds back

If you wish to move your funds back from the Margin Wallet to your regular Binance Wallet, click on “Transfer” and use the button in-between the two wallets to change the direction of the transfer. Next, select the coin and amount and click “Confirm transfer.”

You can move your funds freely from one wallet to another, without any fees. But note that if you currently have assets borrowed, your risk level will increase as the funds of your Margin Wallet decreases. If your Risk Level gets too high, there is a chance of your assets being liquidated. So make sure you understand how margin trading works before using it.

An example

Alice believes the price of BNB will go up, so she wants to open a leveraged long position on BNB. To do so, she first transfers funds to her Margin Wallet and then borrows BTC. Next, Alice uses the borrowed BTC to buy BNB.

If the price of BNB goes up as Alice expected, she can sell her assets and repay the borrowed BTC along with the corresponding interest. Any leftover for that trade will represent her profits.

However, margin trading can amplify both the gains and the losses. So if the market moves against Alice’s position, she will have bigger losses.