Bicoin Prediction Today

Daily Bitcoin Predictions . AMsadad.Com. Greetings, hopefully there will be no profits left behind today, friends in the @trader_ITC group, because today bitcoin is rising wildly as we talked about yesterday.

Stay in the Bitcoin area Bullish Comeback finally today also entered at 1d resistance at the price of 9388 USD – 9420 USD.

Stay in the Bitcoin area Bullish Comeback finally today also entered at 1d resistance at the price of 9388 USD – 9420 USD.

And this adds to my belief in the previous prediction that Bitcoin Towards Golden Cross on 31 January was previously predicted.

If anyone hasn’t read, please read right away and for today I will discuss the next bitcoin resistance.

If anyone hasn’t read, please read right away and for today I will discuss the next bitcoin resistance.

On the 1d bitcoin chart it is still very good for investors to immediately go in and hold up to profit, yes right up to profit therefore if bitcoin correction don’t rush to sell,

Is it possible correction …

Later I will answer on the chart with a smaller TimFrame, and for the 1d bitcoin chart I still say Bitcoin Bullish Comeback .

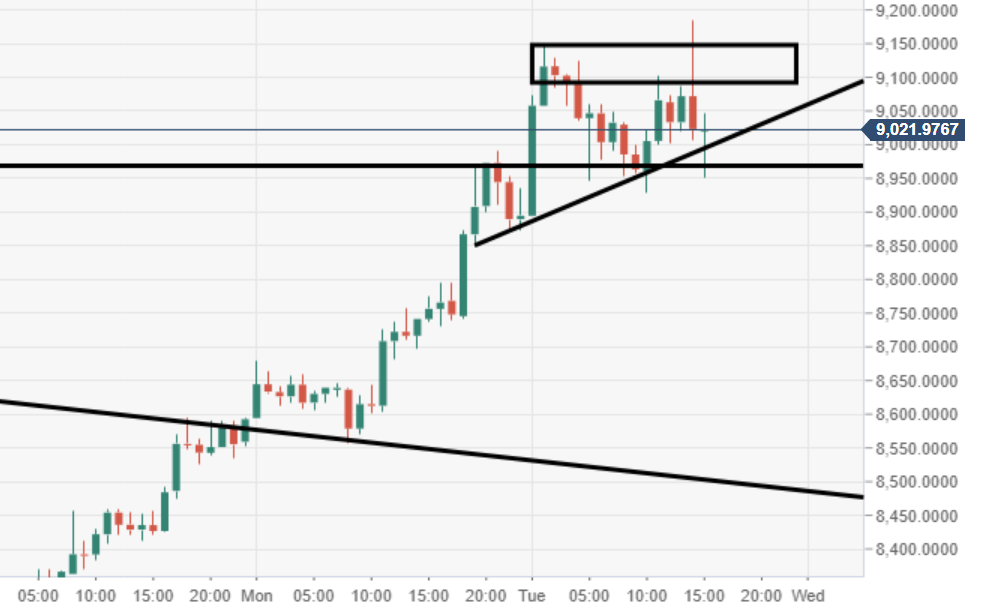

Please pay attention to the smaller Bitcoin Chart because for the accuracy of our predictions it is advisable to be wise in all TFcharts.

If you see above what is your opinion creepy?

So with this I can confirm the answer is maybe bitcoin will experience a quick correction, because TF 4h is already high.

So with this I can confirm the answer is maybe bitcoin will experience a quick correction, because TF 4h is already high.

Yes indeed the TF4h Bitcoin Chart is already high in terms of trends and rsi, there is also a point if if bitcoin gets corrected quickly, however

Bitcoin might be able to fight the current Tf 4h with the proposition of a 1h TF trend that is still pressing the Bullish area.

Of course I totally agree if the 1h bitcoin chart is against the 4h bitcoin chart, because from yesterday actually the bitcoin chart 4h requested correction,

But because the demands of smaller charts like 30m and 1h are demanding to go up, well inevitably have to go up.

But because the demands of smaller charts like 30m and 1h are demanding to go up, well inevitably have to go up.

The condition if we want our prediction 87% to be close to Real is to be able to be wise in comparing tifme bitcoin frame decisions,

Above is a picture of the 1h Bitcoin chart which I have referred to earlier with urgent demands for a 4h bitcoin chart.

But do not rule out if tf 1h also suddenly corrected,

Because as I often say “crypto patterns will repeat with the word correction”.

and I’m also sure that bitcoin will be strong at the 1D level today in the area of 9522 USD – 9899 USD

CONCLUSION S&R

- Prediction of 1H Bitcoin support area 9150 – 9200 usd and resistance 9522 – 9720 USD

- Prediction of 4H Bitcoin support area 9150 – 9200 usd and resistance 9522 – 9860

- Predictions of 1D Bitcoin support area 9000 – 9150 usd and resistance of 10,000 USD

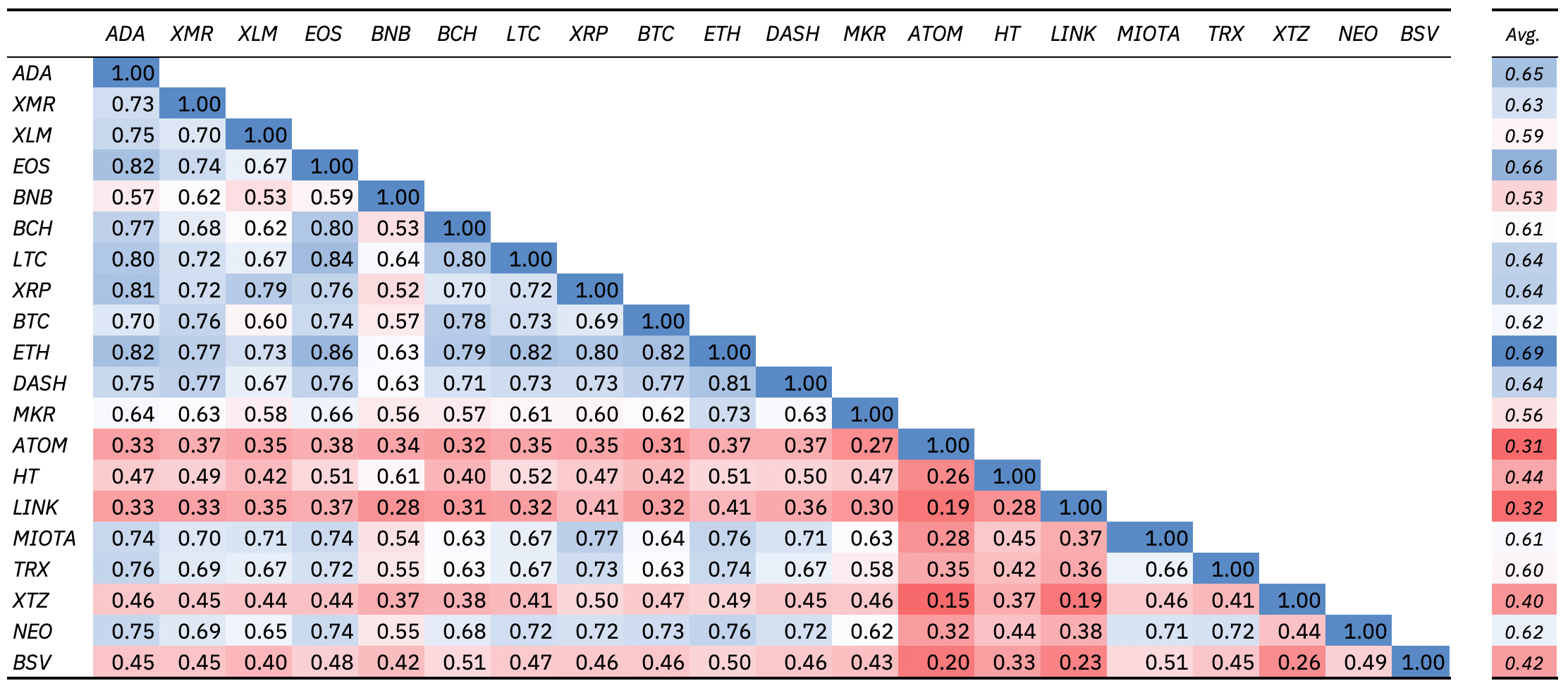

Source: Binance Research

Source: Binance Research